EXL Reports 2025 First Quarter Results

Tuesday, April 29, 20252025 First Quarter Revenue of $501.0 Million, up 14.8% year-over-year

Q1 Diluted EPS (GAAP) (1) of $0.40, up 38.3% from $0.29 in Q1 of 2024

Q1 Adjusted Diluted EPS (Non-GAAP) (1) of $0.48, up 26.9% from $0.38 in Q1 of 2024

New York - April 29, 2025 - ExlService Holdings, Inc. (NASDAQ: EXLS), a global data and AI company, today announced its financial results for the quarter ended March 31, 2025.

Chairman and Chief Executive Officer Rohit Kapoor said, “We are pleased with our first quarter results and strong start to the year, as we delivered revenue and adjusted diluted EPS growth of 15% and 27% respectively. Our strong business momentum underscores the successful execution of our differentiated data and AI-led strategy and demonstrates the enduring resilience and adaptability of EXL’s business model.”

Chief Financial Officer Maurizio Nicolelli said, “While we remain prudent in our outlook given the increasing level of macro-economic uncertainty, we are increasing our revenue guidance for the year, based on our business momentum and more favorable currency exchange rates. We now expect revenue to be in the range of $2.035 billion to $2.065 billion, up from our prior guidance of $2.025 billion to $2.060 billion. This represents 11% to 12% year-over-year growth on a reported basis, or 11% to 13% on a constant currency basis. We continue to expect our adjusted diluted earnings per share for 2025 to be in the range of $1.83 to $1.89, representing an 11% to 14% increase over 2024, as we continue to accelerate our data and AI investments to generate future growth.”

______________________________________________________________

- Reconciliations of adjusted (non-GAAP) financial measures to the most directly comparable GAAP measures, where applicable, are included at the end of this release under “Reconciliation of Adjusted Financial Measures to GAAP Measures.” These non-GAAP measures, including adjusted diluted EPS and constant currency measures, are not measures of financial performance prepared in accordance with GAAP.

Financial Highlights: First Quarter 2025

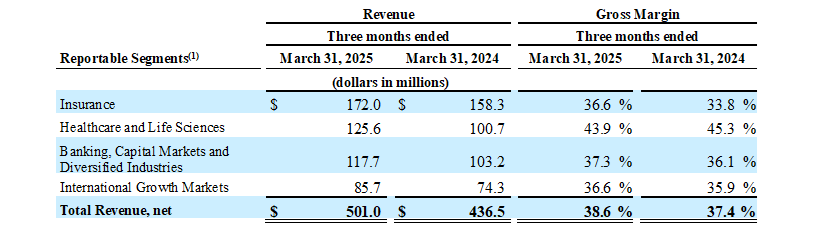

- Revenue for the quarter ended March 31, 2025, increased to $501.0 million compared to $436.5 million for the first quarter of 2024, an increase of 14.8% on a reported basis and 15.1% on a constant currency basis. Revenue increased by 4.1% sequentially on a reported basis and 4.3% on a constant currency basis, from the fourth quarter of 2024.

(1) In the first quarter of 2025, the Company implemented operational and structural changes to accelerate the execution of its data and AI-led strategy. Under the new structure, the Company reports its financial performance based on new segments presented in the table above, and as described in more detail in its Quarterly Report on Form 10-Q for the three months ended March 31, 2025, that is being filed with the SEC. In conjunction with the new reporting structure, the Company has recast prior period amounts, wherever applicable, to conform to the way the Company internally manages and monitors segment performance.

- Operating income margin for the quarter ended March 31, 2025 was 15.7%, compared to 14.1% for the first quarter of 2024 and 14.8% for the fourth quarter of 2024. Adjusted operating income margin for the quarter ended March 31, 2025 was 20.1%, compared to 18.9% for the first quarter of 2024 and 18.8% for the fourth quarter of 2024.

- Diluted earnings per share for the quarter ended March 31, 2025 was $0.40, compared to $0.29 for the first quarter of 2024 and $0.31 for the fourth quarter of 2024. Adjusted diluted earnings per share for the quarter ended March 31, 2025 was $0.48, compared to $0.38 for the first quarter of 2024 and $0.44 for the fourth quarter of 2024.

Business Highlights: First Quarter 2025

- Won 10 new clients in the first quarter of 2025.

- Named a Leader in four categories in the ISG Provider Lens™ Insurance Services 2024 report. Earning top honors in the North American Life & Retirement, Property & Casualty, Life & Retirement TPA Insurance Services, and Insurance IT Services.

- Named a Leader and a Star Performer in Everest Group’s Life and Annuities Insurance Business Process Services and Third-Party Administrator (TPA) PEAK Matrix® Assessment 2025.

- Recognized as part of Newsweek’s America’s Most Responsible Companies 2025, Forbes’ Most Trusted Companies in America 2025, USA Today's America’s Climate Leaders 2025, and The Financial Times’ Best Employers Asia-Pacific 2025.

2025 Guidance

Based on current visibility, and a U.S. dollar to Indian rupee exchange rate of 85.5, U.K. pound sterling to U.S. dollar exchange rate of 1.30, U.S. dollar to the Philippine peso exchange rate of 57.0 and all other currencies at current exchange rates, we are providing the following guidance for the full year 2025:

- Revenue of $2.035 billion to $2.065 billion, representing an increase of 11% to 12% on a reported basis, and 11% to 13% on a constant currency basis from 2024; and

- Adjusted diluted earnings per share of $1.83 to $1.89, representing an increase of 11% to 14% from 2024.

Conference Call

ExlService Holdings, Inc. will host a conference call on Wednesday, April 30, 2025 at 10:00 A.M. ET to discuss the Company’s quarterly operating and financial results. The conference call will be available live via the internet by accessing the investor relations section of EXL’s website at ir.exlservice.com, where an accompanying investor-friendly spreadsheet of historical operating and financial data can also be accessed. Please access the website at least fifteen minutes prior to the call to register, download and install any necessary audio software.

Please note that there is a new system to access the live call-in order to ask questions. To join the live call, please register here. A dial-in and unique PIN will be provided to join the call. For those who cannot access the live broadcast, a replay will be available on the EXL website ir.exlservice.com for a period of twelve months.

About ExlService Holdings, Inc.

EXL (NASDAQ: EXLS) is a global data and artificial intelligence ("AI") company that offers services and solutions to reinvent client business models, drive better outcomes and unlock growth with speed. EXL harnesses the power of data, AI, and deep industry knowledge to transform businesses, including the world’s leading corporations in industries including insurance, healthcare, banking and financial services, media and retail, among others. EXL was founded in 1999 with the core values of innovation, collaboration, excellence, integrity and respect. We are headquartered in New York and have more than 60,000 employees spanning six continents. For more information, visit www.exlservice.com.

Cautionary Statement Regarding Forward-Looking Statements This press release contains forward-looking statements within the meaning of the United States Private Securities Litigation Reform Act of 1995. You should not place undue reliance on those statements because they are subject to numerous uncertainties and factors relating to EXL's operations and business environment, all of which are difficult to predict and many of which are beyond EXL’s control. Forward-looking statements include information concerning EXL’s possible or assumed future results of operations, including descriptions of its business strategy. These statements may include words such as “may,” “will,” “should,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate” or similar expressions. These statements are based on assumptions that we have made in light of management's experience in the industry as well as its perceptions of historical trends, current conditions, expected future developments and other factors it believes are appropriate under the circumstances. You should understand that these statements are not guarantees of performance or results. They involve known and unknown risks, uncertainties and assumptions. Although EXL believes that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect EXL’s actual financial results or results of operations and could cause actual results to differ materially from those in the forward-looking statements. These factors, which include our ability to maintain and grow client demand, our ability to hire and retain sufficiently trained employees, and our ability to accurately estimate and/or manage costs, rising interest rates, rising inflation and recessionary economic trends, are discussed in more detail in EXL’s filings with the Securities and Exchange Commission, including EXL’s Annual Report on Form 10-K. You should keep in mind that any forward-looking statement made herein, or elsewhere, speaks only as of the date on which it is made. New risks and uncertainties come up from time to time, and it is impossible to predict these events or how they may affect EXL. EXL has no obligation to update any forward-looking statements after the date hereof, except as required by applicable law.

For a full view of EXL’s financial tables, click here.